FICA Tax: What is FICA Tax, Rates, Exemptions and Calculations

Por um escritor misterioso

Descrição

A guide to understanding the FICA tax, also called payroll tax - the mandatory deduction from your employee’s payroll. Know your FICA tax rates, exemptions, & tips

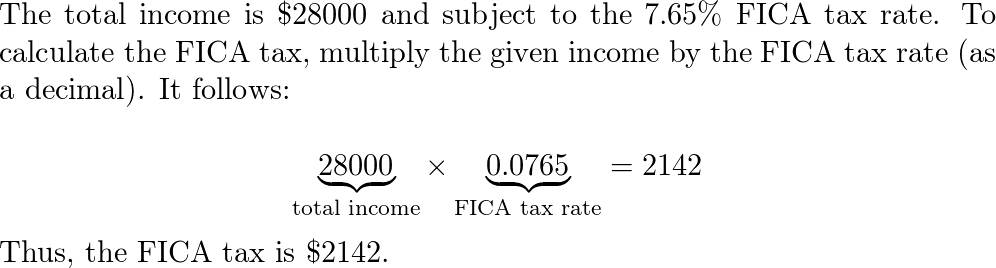

Understanding the FICA Tax Short for the Federal Insurance Contributions Act, FICA refers to the American law that requires both employees and employers to contribute to the cost of the Social Security and Medicare programs in the US. Therefore, the FICA tax refers to the taxes paid in accordance with this law. Let’s dive deeper with this essential guide to the FICA tax. What is the FICA Tax? The FICA tax is a mandatory deduction from an employee’s payroll. American employers must withhold a

Understanding the FICA Tax Short for the Federal Insurance Contributions Act, FICA refers to the American law that requires both employees and employers to contribute to the cost of the Social Security and Medicare programs in the US. Therefore, the FICA tax refers to the taxes paid in accordance with this law. Let’s dive deeper with this essential guide to the FICA tax. What is the FICA Tax? The FICA tax is a mandatory deduction from an employee’s payroll. American employers must withhold a

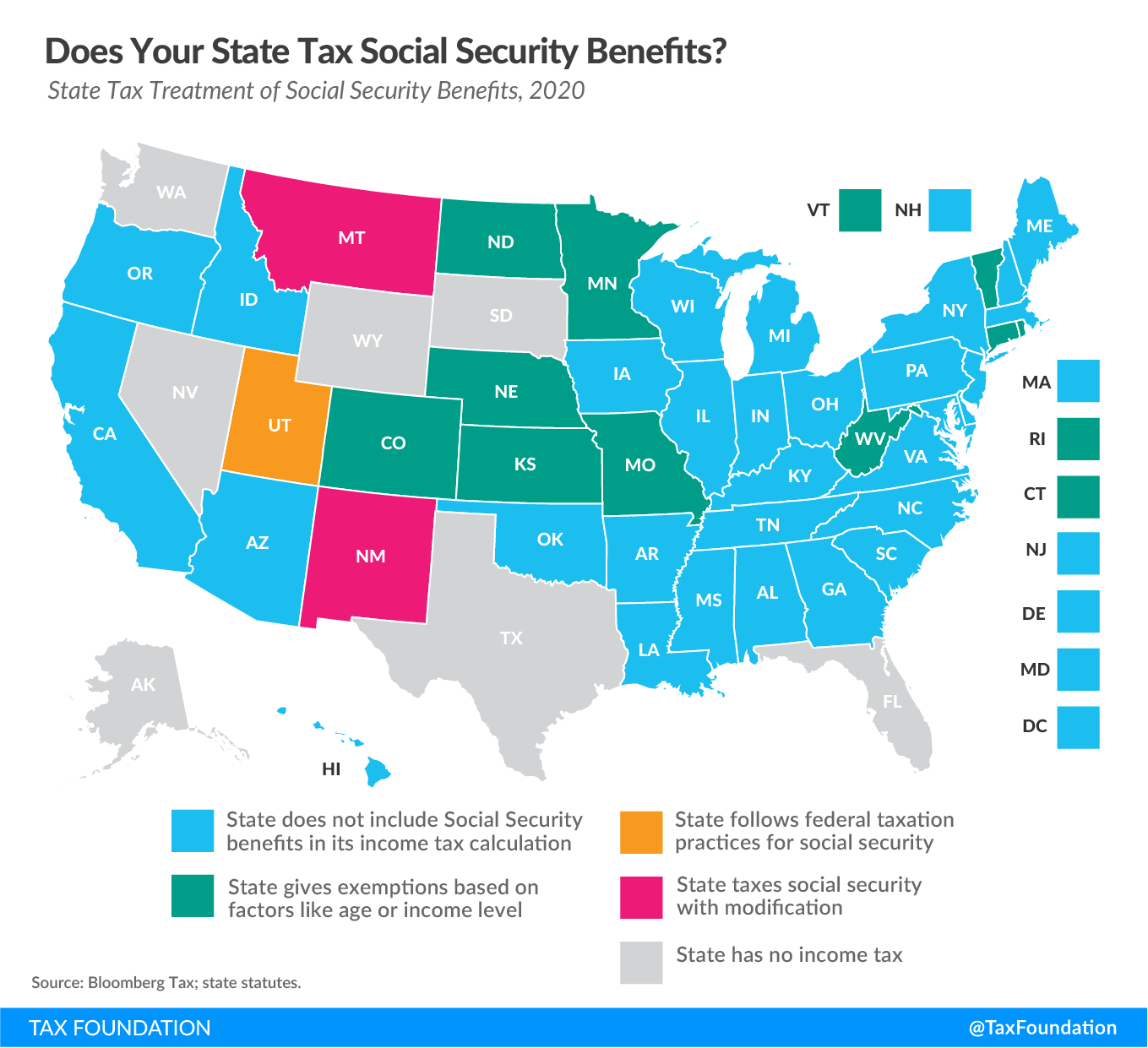

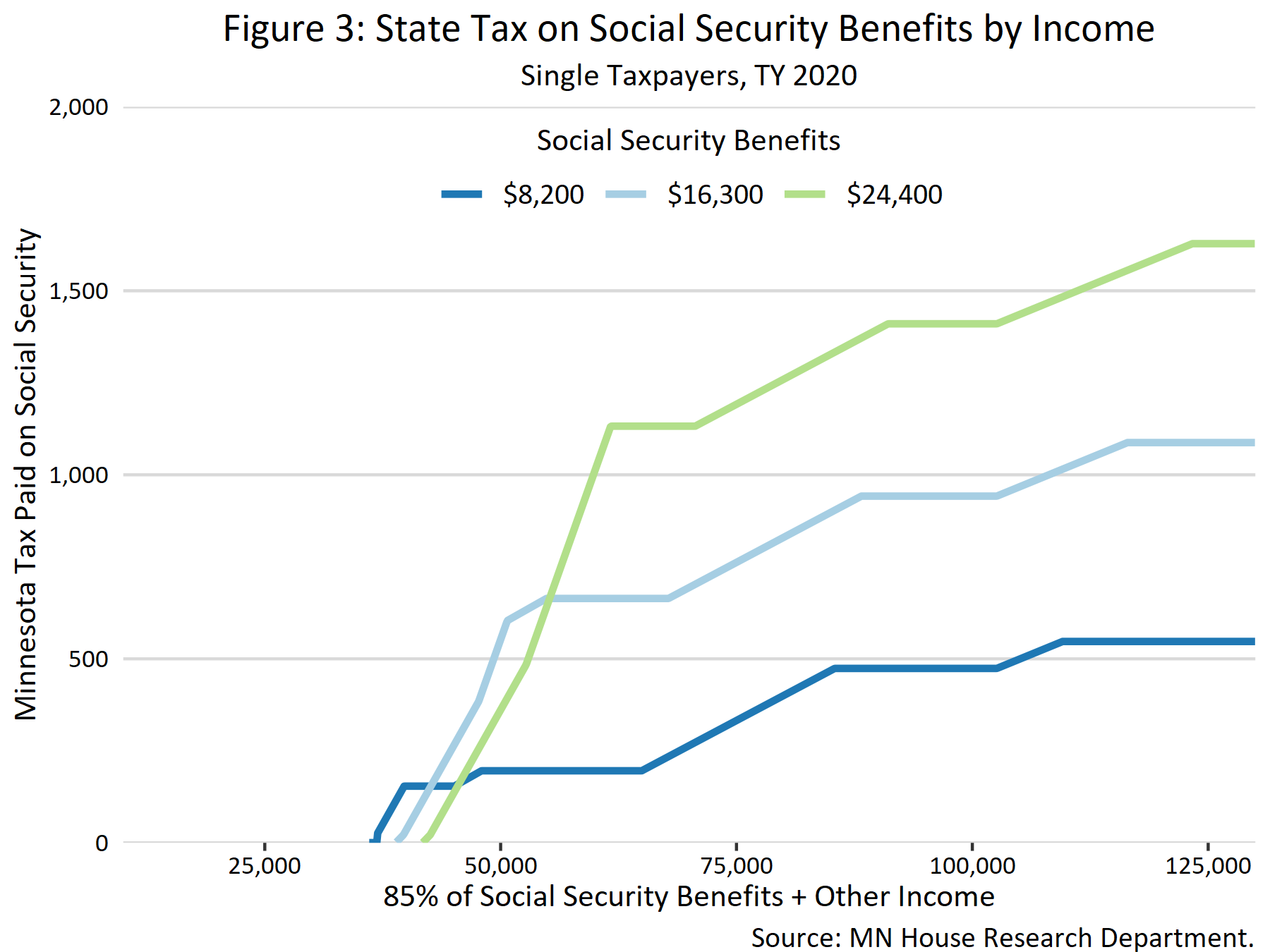

States That Tax Social Security Benefits

Payroll tax - Wikipedia

Calculate the FICA taxes and income taxes to obtain the tota

FICA Tax: What is FICA Tax, Rates, Exemptions and Calculations

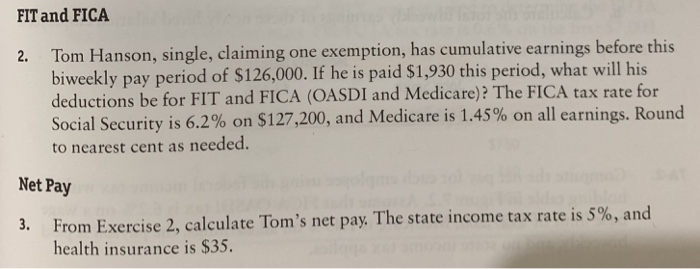

Solved FIT and FICA 2. Tom Hanson, single, claiming one

FICA explained: Social Security and Medicare tax rates to know in 2023

Taxation of Social Security Benefits - MN House Research

What is the FICA Tax? - 2023 - Robinhood

FICA Tax Guide (2023): Payroll Tax Rates & Definition - SmartAsset

Employers responsibility for FICA payroll taxes

Social Security and Medicare • Activity Builder by Desmos

2023 Social Security Wage Base Increases to $160,200

de

por adulto (o preço varia de acordo com o tamanho do grupo)

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)