FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

Por um escritor misterioso

Descrição

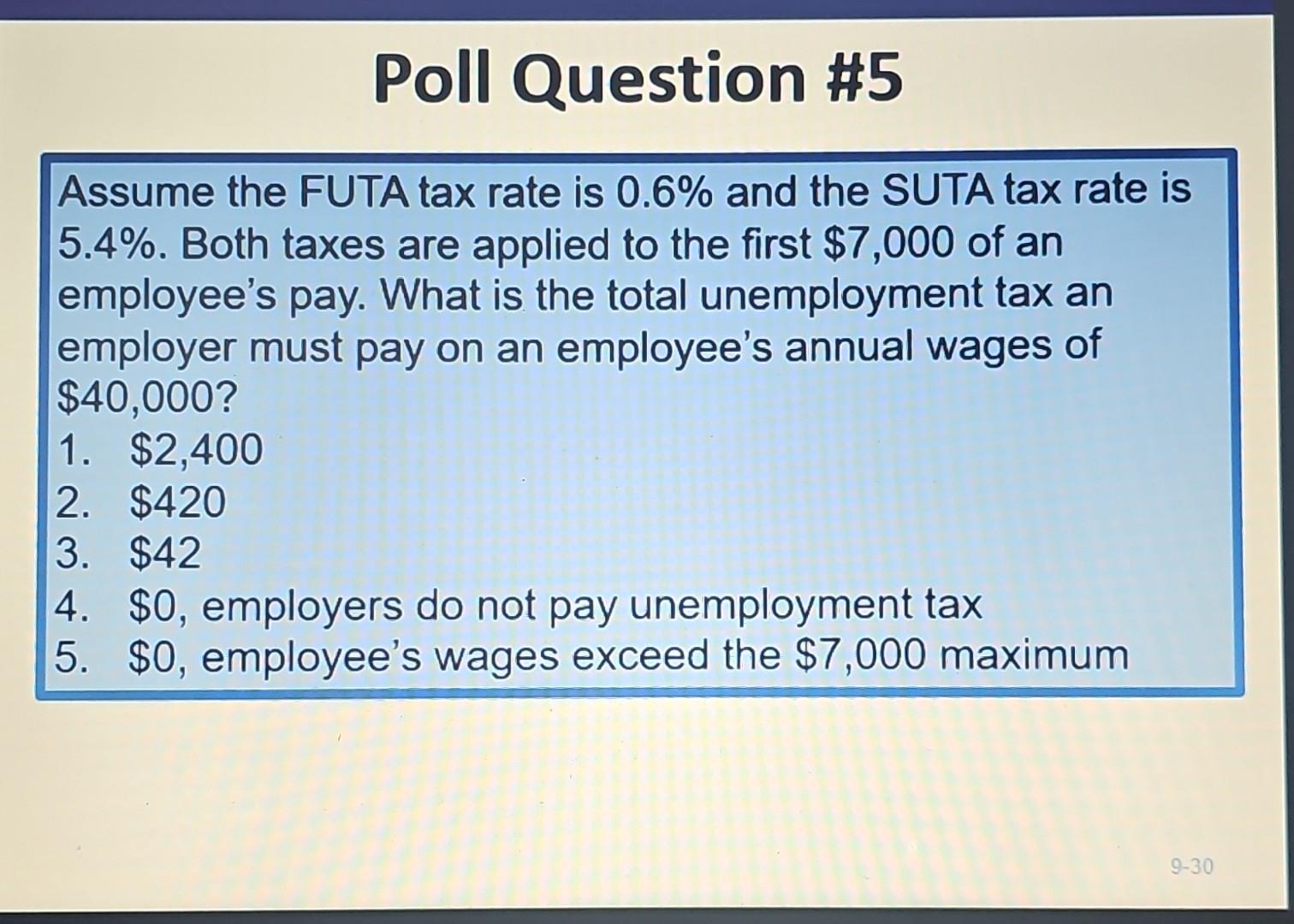

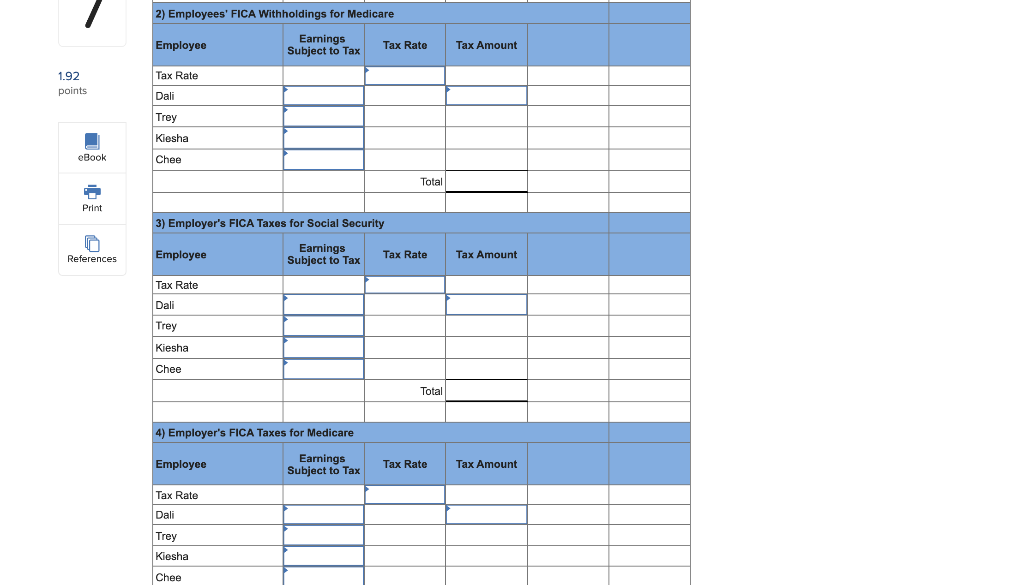

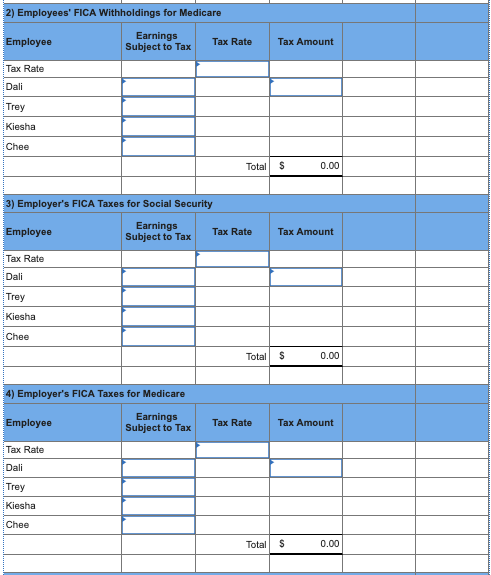

Employers and employees must pay FICA taxes to contribute to social security and medicare. What you need to know.

Solved An employee earned $50,000 during the year. FICA tax

Tax relief for good deeds

Self-Employed Health Insurance Deductions

Paycheck Taxes - Federal, State & Local Withholding

Federal Insurance Contributions Act: FICA - FasterCapital

Self-Employed Retirement Plans: Know Your Options - NerdWallet

Zelle Taxes: Why This Payment App Is Different - NerdWallet

How to Ask for a Raise in an Uncertain Economy - NerdWallet

20 Popular Tax Deductions and Tax Breaks for 2023-2024 - NerdWallet

How Much Should I Pay My Employees? - NerdWallet

Solved Paloma Company has four employees. FICA Social

What is a 401(k) Plan? - NerdWallet

Solved Paloma Co. has four employees. FICA Social Security

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

de

por adulto (o preço varia de acordo com o tamanho do grupo)