What Is FICA Tax, Understanding Payroll Tax Requirements

Por um escritor misterioso

Descrição

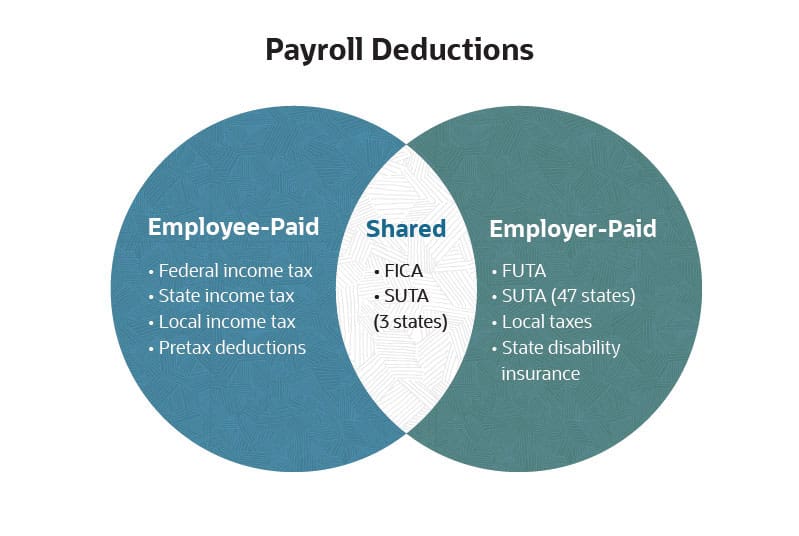

FICA tax refers to the taxes withheld by employers for Social Security and Medicare. Learn more about the FICA tax and how it’s calculated.

According to the accountant of Ulster Inc., its payroll taxes for the week were as follows: $138.50 for FICA taxes, $18.50 for federal unemployment taxes, and $89.50 for state unemployment taxes. Jo

Payroll Tax Rates (2023 Guide) – Forbes Advisor

What Is FICA Tax, Understanding Payroll Tax Requirements

Payroll Tax: Definition, Examples, and Costs

How An S Corporation Reduces FICA Self-Employment Taxes

Payroll Tax: What It Is, How to Calculate It

2019 Payroll Tax Updates: Social Security Wage Base, Medicare & FICA Tax Rates - CheckmateHCM

FICA Tax: 4 Steps to Calculating FICA Tax in 2023

Understanding Your Paycheck

What Is FICA Tax, Understanding Payroll Tax Requirements

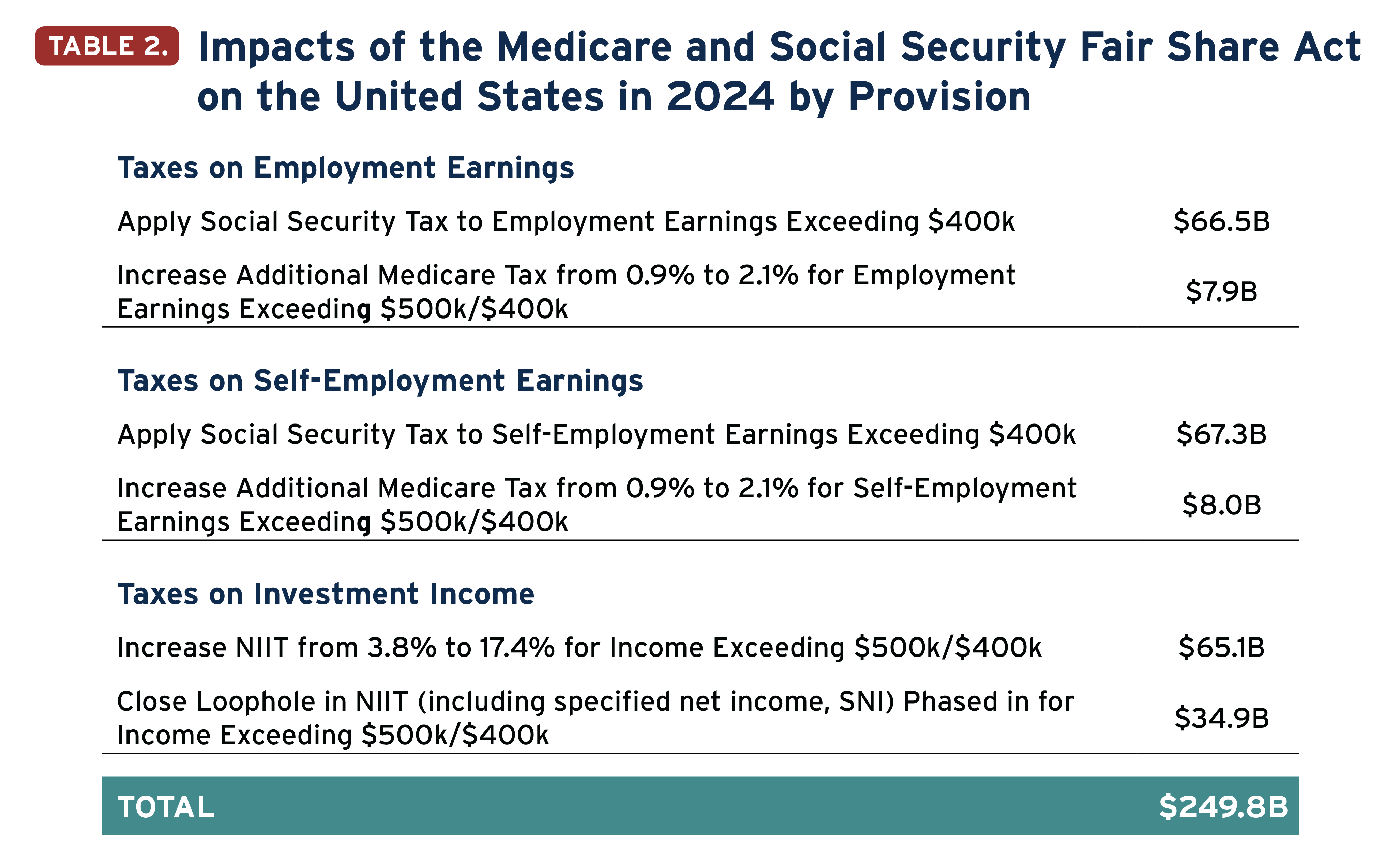

Fair Share Act' Would Strengthen Medicare and Social Security Taxes – ITEP

de

por adulto (o preço varia de acordo com o tamanho do grupo)