What it means: COVID-19 Deferral of Employee FICA Tax

Por um escritor misterioso

Descrição

On August 8, 2020, President Trump signed an Executive Order Deferring Employee FICA Taxes. We’ve put together a guide clarifying what the order means and who it applies to.

EO “Deferring” Taxes – What Employers Need to Know to Maintain Compliance

What it means: COVID-19 Deferral of Employee FICA Tax

How to Defer Social Security Tax (COVID-19)

How The Coronavirus Payroll Tax Deferral Affects Pastors - The Pastor's Wallet

Maximum Deferral of Self-Employment Tax Payments

Interested in the payroll tax deferral? Here's how it will work

Here's what Trump's executive order deferring payroll taxes means for workers

IRS Issues Guidance on Payroll Tax Deferment Presidential Order

Heads Up – Deferred FICA Tax Due Soon - AccuPay, Payroll and Tax Services

Lacking Time and Guidance, Businesses Won't Defer Employees' Payroll Taxes

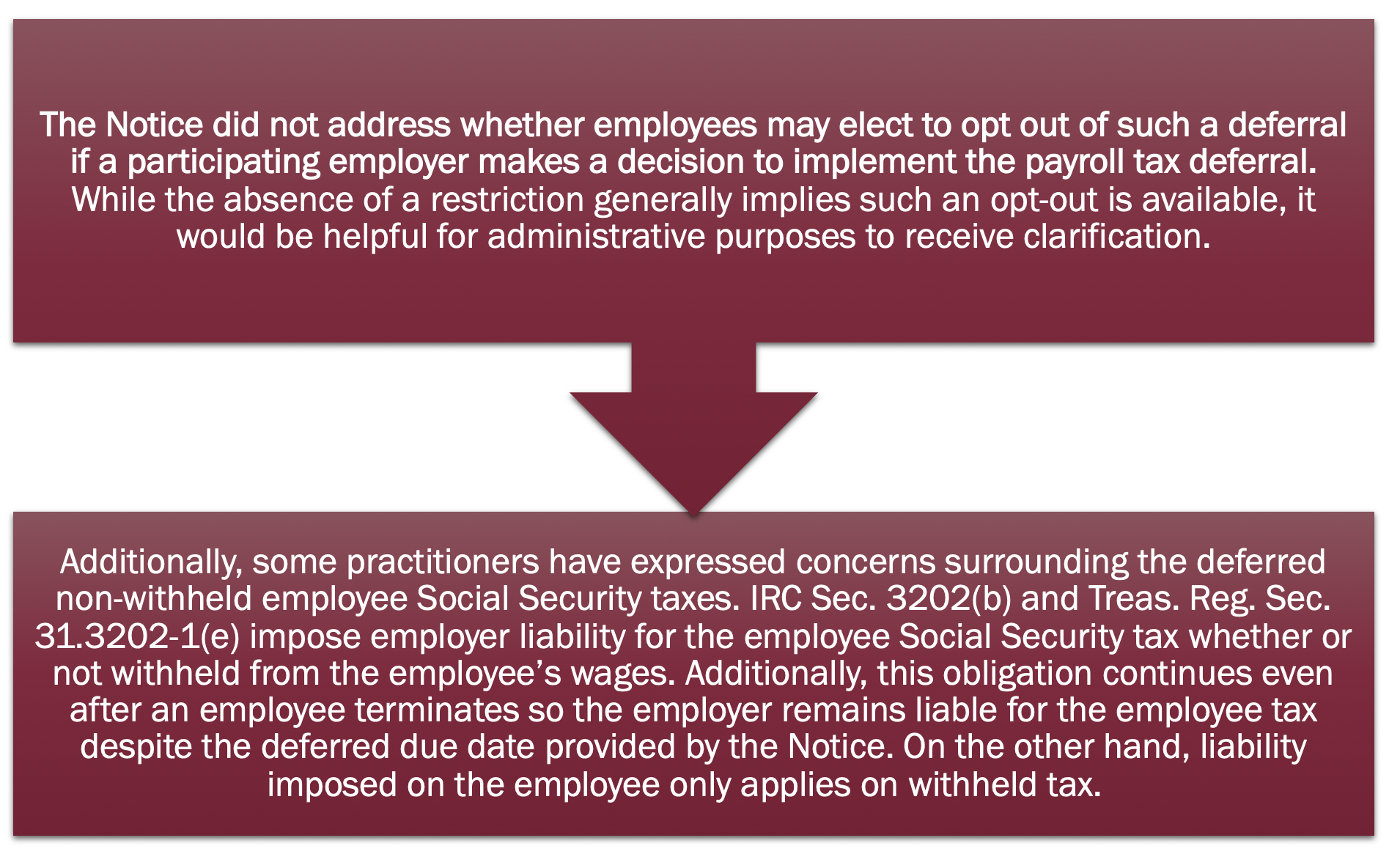

COVID-19 Payroll Tax Relief Raises Questions — Zenith American Solutions Blog

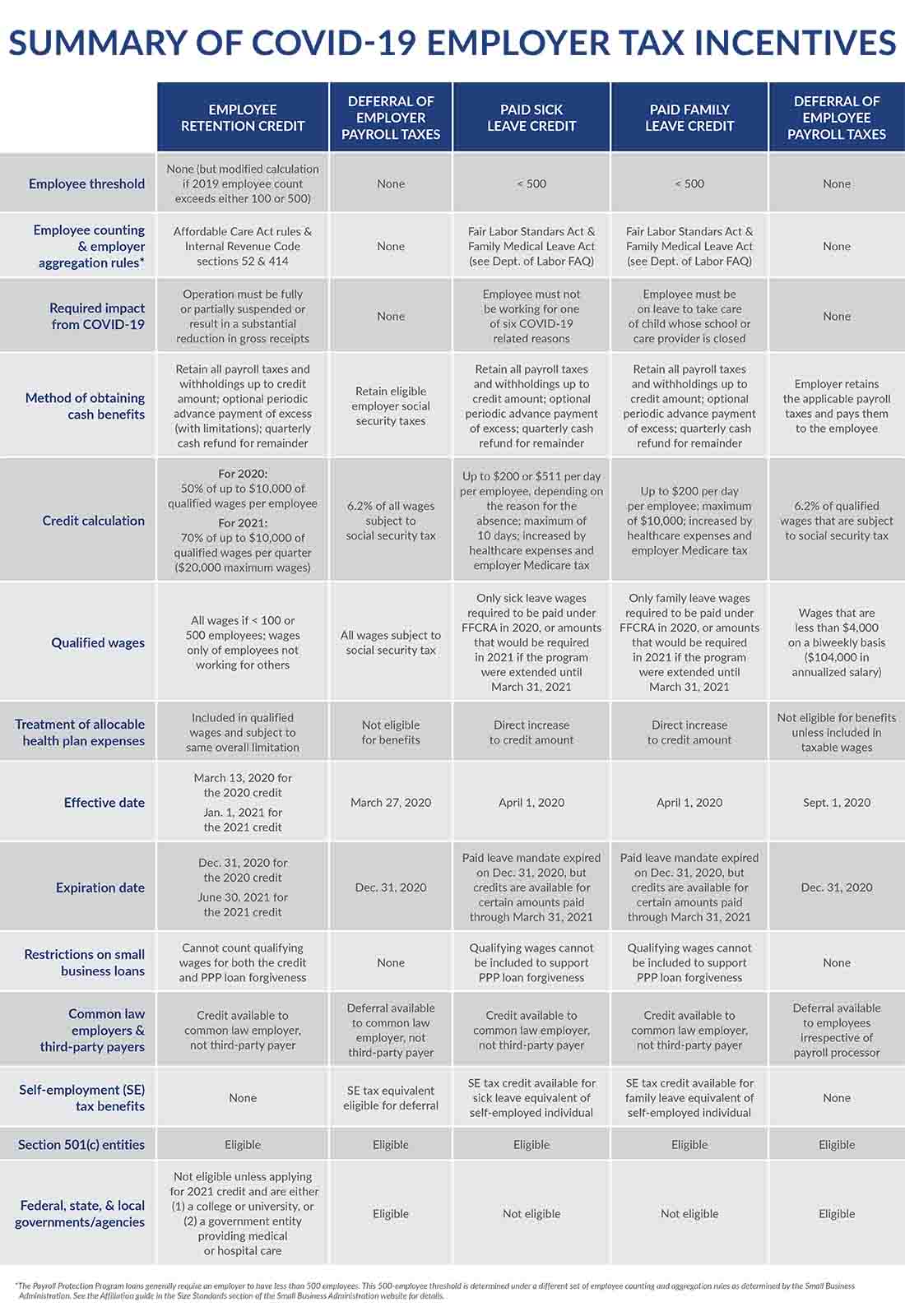

Comparison of COVID-19 employer tax incentives, Our Insights

Trump Memo on Payroll Tax Deferral Creates a Tax Nightmare - Alliance Law Firm International PLLC

Pay It Now or Pay It Later…What You Need to Know about Deferral of Employee Social Security Tax - PYA

de

por adulto (o preço varia de acordo com o tamanho do grupo)

:max_bytes(150000):strip_icc()/fica-taxes-and-calculator-on-a-table--874829160-42e252082fb1486dae0bc7cddbcaa16e.jpg)