Tackling the tax code: Efficient and equitable ways to raise revenue

Por um escritor misterioso

Descrição

This book presents new proposals for a value-added tax, a financial transactions tax, wealth and inheritance taxes, reforming the corporate and international tax systems, and giving the Internal Revenue Service the resources it needs to ensure that tax laws are better enforced and administered.

Difference Between a Tax Audit and Financial Audit - Vakilsearch

How taxation works for AIF and PMS investors » Capitalmind

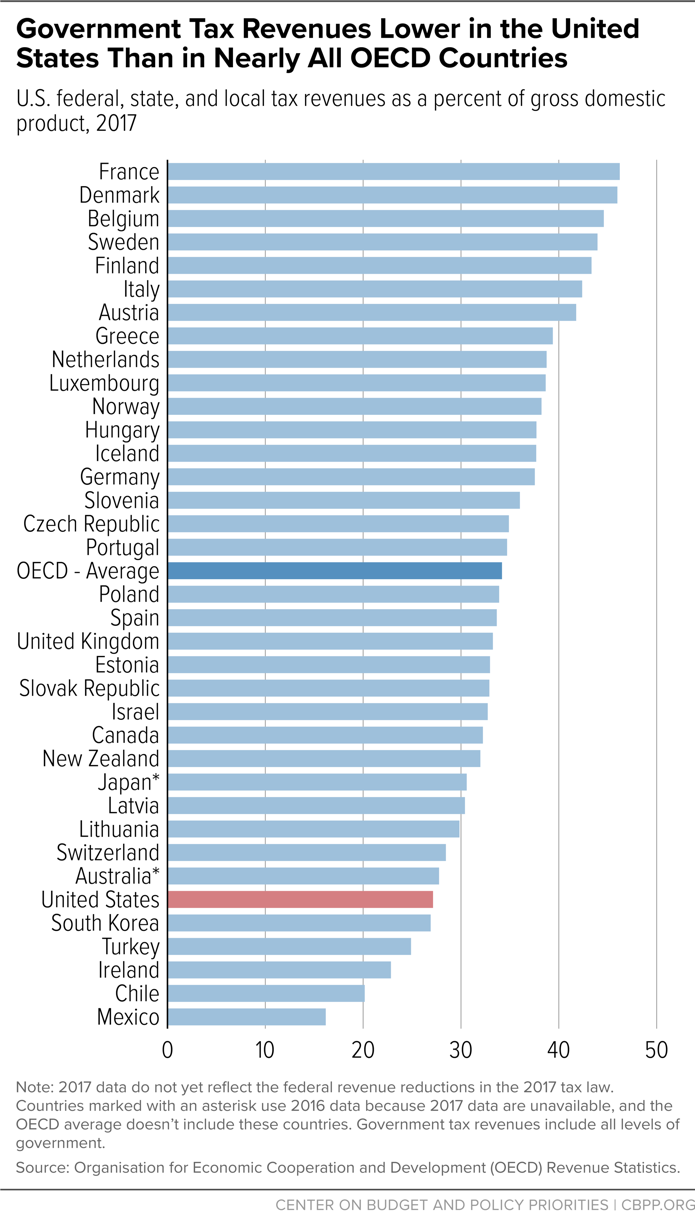

Efficient and Equitable Tax Systems

Tax policy: Tax Policy and the Ability to Pay: Shaping Economic

How the Federal Tax Code Can Better Advance Racial Equity

Towards a new tax system in Ukraine

Tackling the tax code: Efficient and equitable ways to raise

Progressive tax - Wikipedia

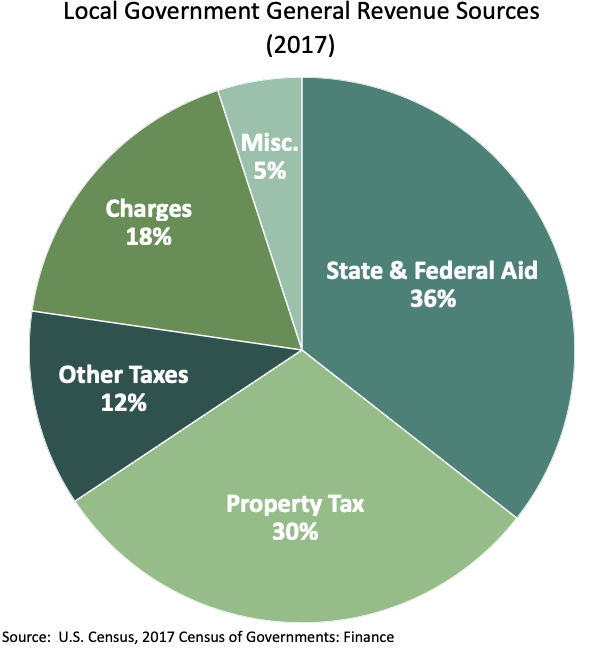

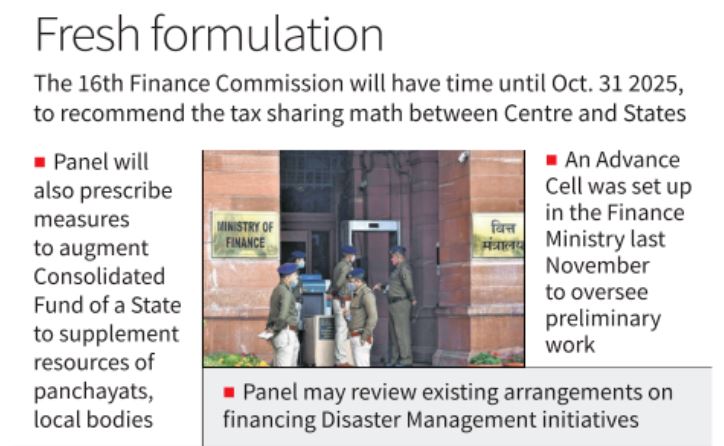

Finance Commission - Issues related to devolution of resources

PDF) Tax Reduction Strategies for the Entry of Taxpayers to Reduce

No it's not your money: why taxation isn't theft - Tax Justice Network

de

por adulto (o preço varia de acordo com o tamanho do grupo)

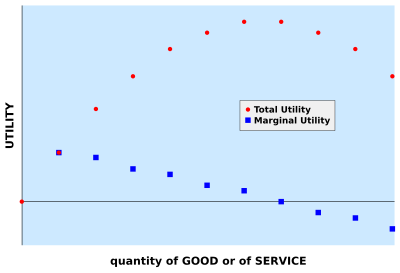

:max_bytes(150000):strip_icc()/Law-of-Diminishing-Marginal-Utility-7334854b88ad474bbb7e97ae928eac88.jpg)

:max_bytes(150000):strip_icc()/five-determinants-of-demand-with-examples-and-formula-3305706-2022-02a2302a2f974d6c9c953f4a3be50889.png)