Withholding FICA Tax on Nonresident employees and Foreign Workers

Por um escritor misterioso

Descrição

The proper determination of FICA tax exemption for nonresident employees has become particularly tricky for payroll staff in organizations across the US. In this guide, we share some tips for effective management of nonresident payroll.

Which visa holders are exempt from Social Security and Medicare taxes?

Income Taxes and FICA Withholding Exemption(s) for Foreign Workers

Which Employees Are Exempt From Tax Withholding?

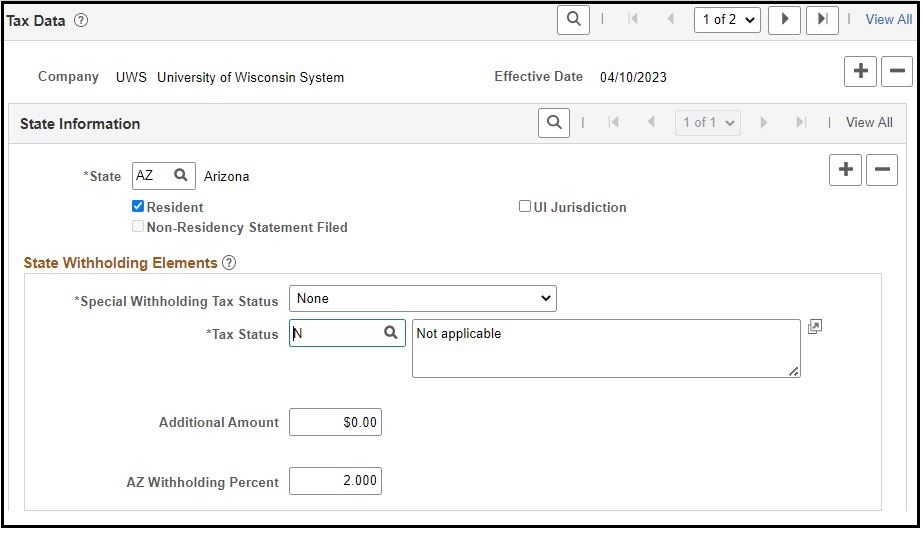

Foreign National Tax Compliance

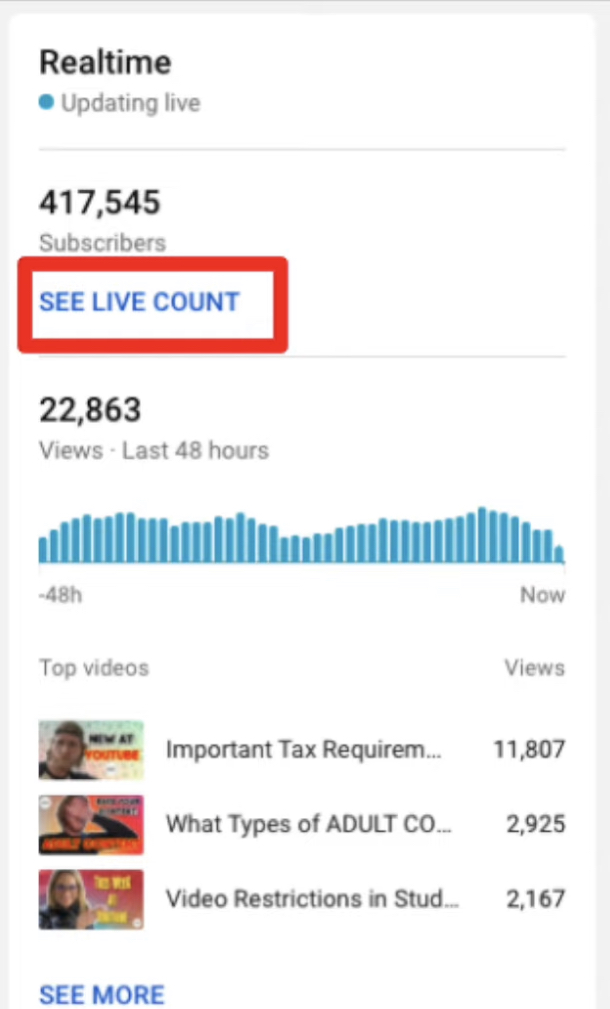

UW–Shared Services KnowledgeBase

As an international student, how do I get refunds on FICA tax

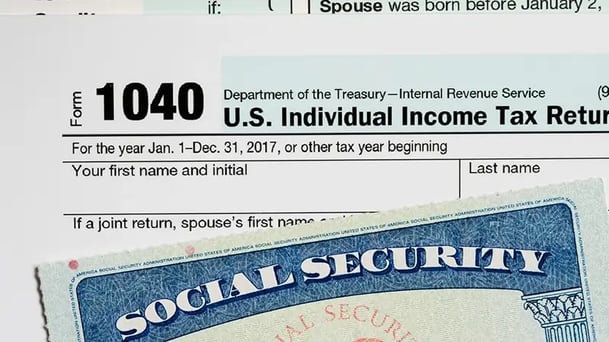

US Nonresident Alien Income Tax Return: Form 1040 NR

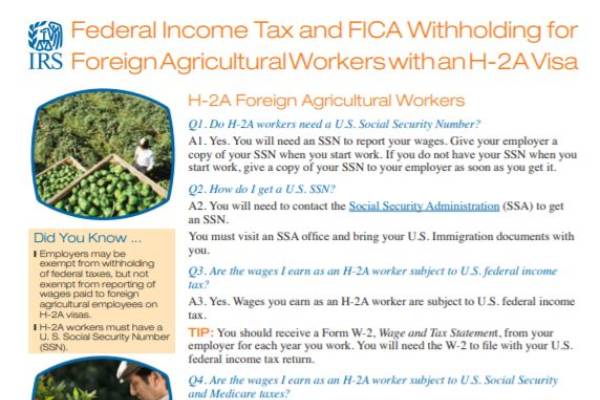

Federal Income Tax and FICA Withholding for Foreign Agricultural

FICA: Definition, 2022 Rates and Limits, Rules for Self-Employed

How To Calculate Payroll Taxes? FUTA, SUI and more

:max_bytes(150000):strip_icc()/ManageYourMoneySpreadsheet-79f96156543c46c89fbaf6166b747824.jpeg)

Medicare and Social Security Tax Refunds

What Is FICA?

Federal Insurance Contributions Act - Wikipedia

de

por adulto (o preço varia de acordo com o tamanho do grupo)