What Eliminating FICA Tax Means for Your Retirement

Por um escritor misterioso

Descrição

A recent poll out said that over 60% of current retirees are relying on social security and Medicare for a majority of their income in retirement. So while getting rid of FICA tax sounds nice now because nobody likes paying taxes, it could be detrimental not just to retirees or when you can retire

FICA Tax: Unraveling the Mystery Behind Social Security Contributions - FasterCapital

7 changes Americans are willing to make to fix Social Security

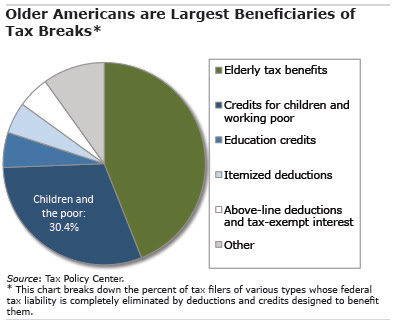

Why Most Elderly Pay No Federal Tax – Center for Retirement Research

What Eliminating FICA Tax Means for Your Retirement

Some States Tax Your Social Security Benefits

What Every Retirement Saver Needs to Know About 2022

Social Security (United States) - Wikipedia

FICA Tax: Unraveling the Mystery Behind Social Security Contributions - FasterCapital

Eliminating Social Security caps has some serious risks - The Washington Post

How Social Security's Windfall Elimination Provision Affects Some Federal Retirees

Taxability and Nontaxability of Social Security Benefits - U of I Tax School

Who Is Exempt From Social Security Taxes? - SmartAsset

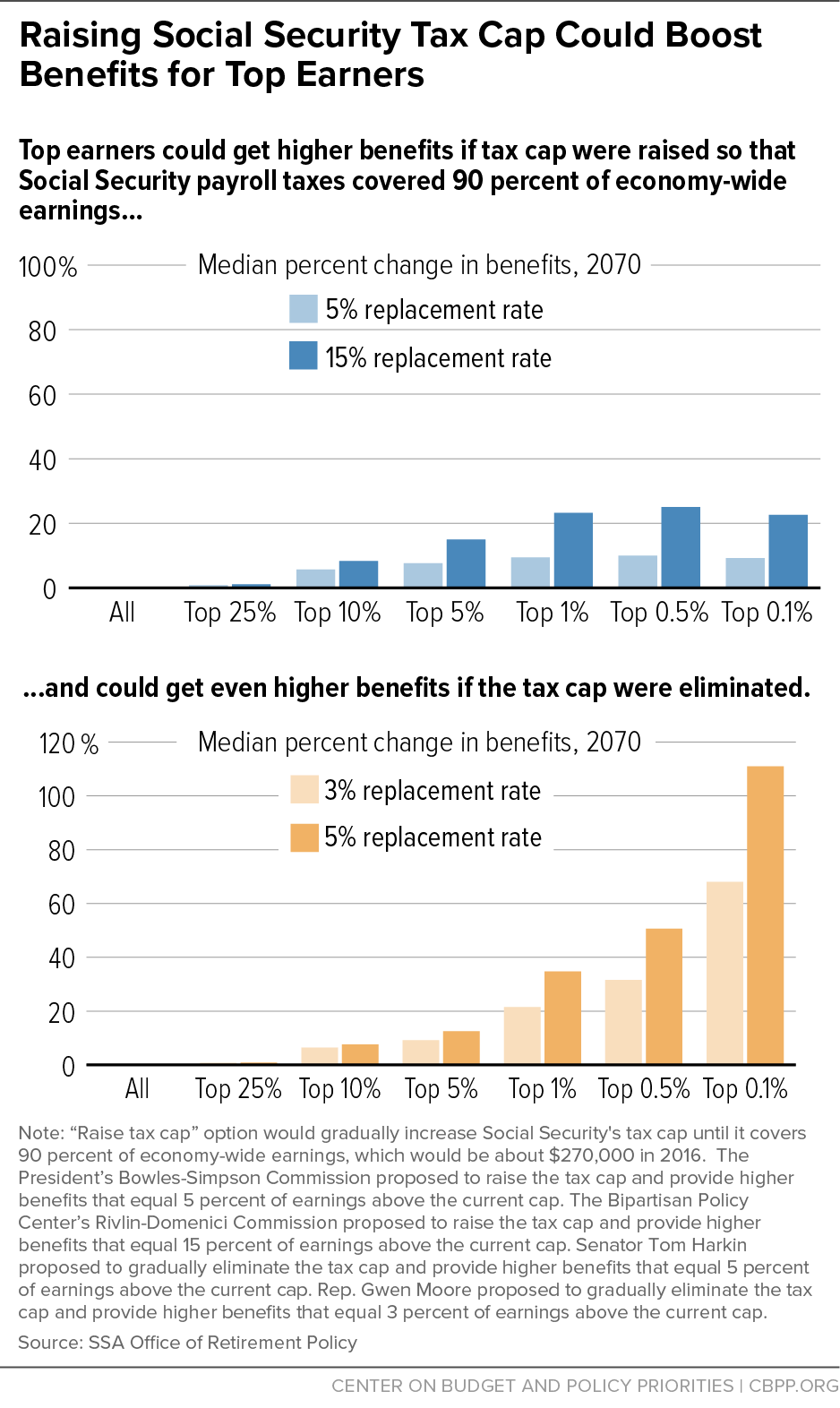

Increasing Payroll Taxes Would Strengthen Social Security

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons

de

por adulto (o preço varia de acordo com o tamanho do grupo)