Publication 970 (2022), Tax Benefits for Education

Por um escritor misterioso

Descrição

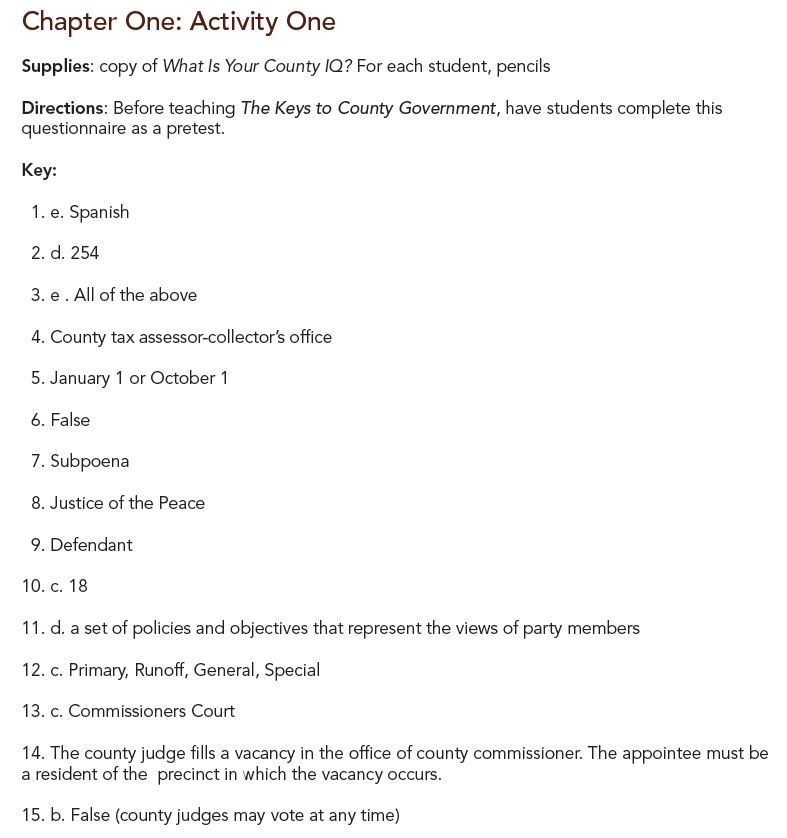

Publication 970 - Introductory Material Future Developments What's New Reminders

Educational Credits Covered California MAGI Income publication 970

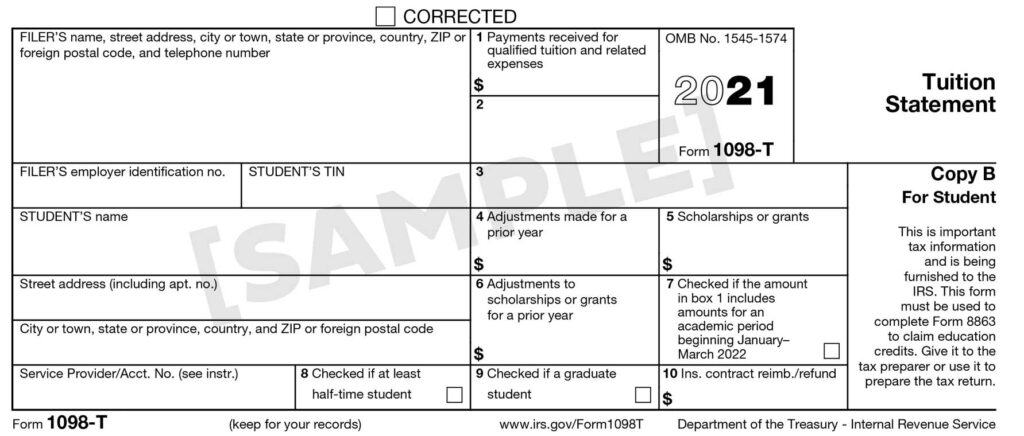

Tax Credit – 1098-T, Student Financial Services

New 2022 IRS Income Tax Brackets And Phaseouts For Education Tax Breaks

Educational Tax Credits and Deductions You Can Claim for Tax Year 2022, Taxes

New 2022 IRS Income Tax Brackets And Phaseouts For Education Tax Breaks

Education tax credits: Maximizing Savings with IRS Pub 970 - FasterCapital

Teachers' out-of-pocket classroom costs worth $300 tax break - Don't Mess With Taxes

Teachers' out-of-pocket classroom costs worth $300 tax break - Don't Mess With Taxes

New school year reminder to educators; maximum educator expense deduction is $300 in 2023

Tax Information - Spartan Central

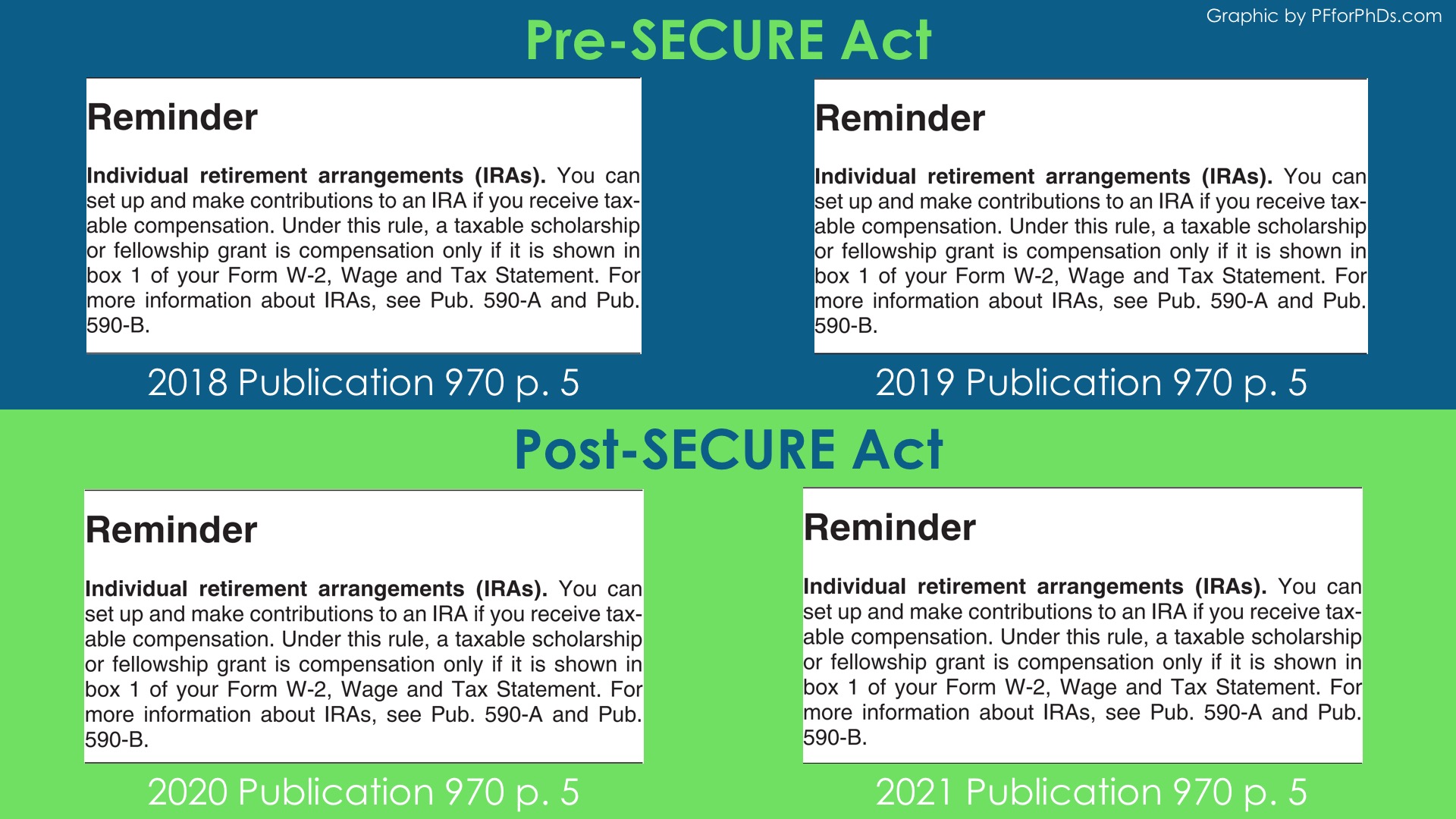

Is Fellowship Income Eligible to Be Contributed to an IRA? - Personal Finance for PhDs

How to Interpret the 1098-T

de

por adulto (o preço varia de acordo com o tamanho do grupo)