Retired? You May Want Stocks, Not Bonds, to Power Your Portfolio

Por um escritor misterioso

Descrição

If you're already retired, it may be time to rethink the role that stocks and bonds play in your portfolio. While conventional wisdom suggests that investors should shift more assets to bonds as they approach retirement, at least one expert … Continue reading → The post Retired? Here's Why Stocks, Not Bonds, Should Still Power Your Portfolio appeared first on SmartAsset Blog.

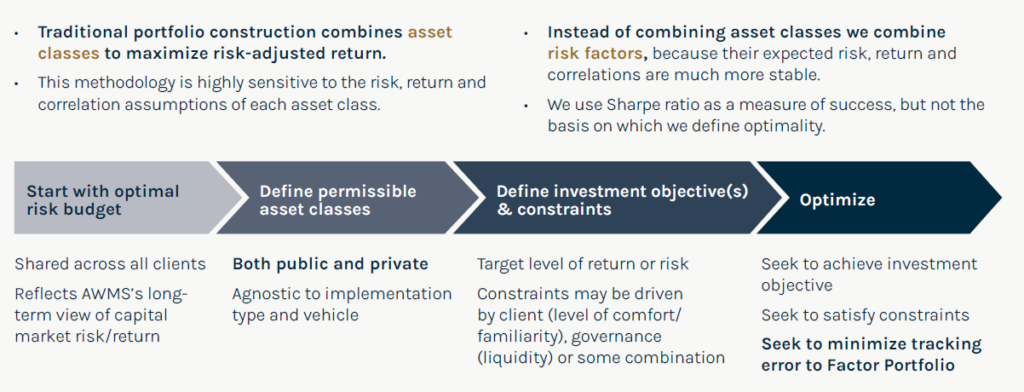

Out with the Old and in with the New: a 50% Private Markets Portfolio - InvestmentNews

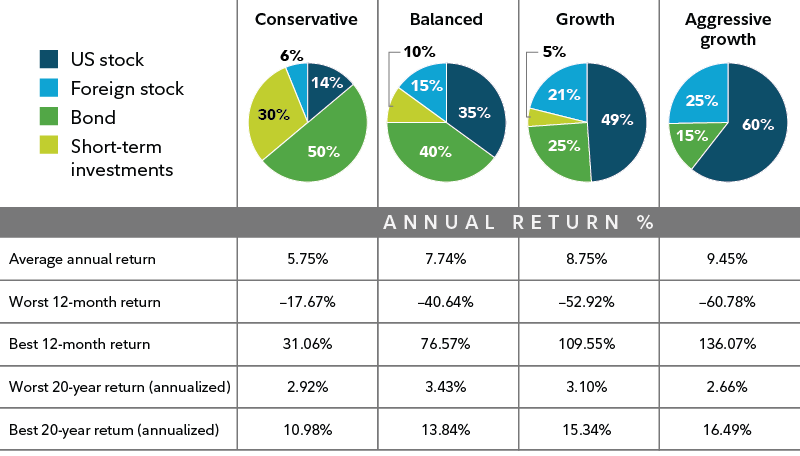

How to build your investments into a portfolio

How To Allocate And Rebalance A Retirement Portfolio

Using Economic Context In Retirement Income Decision-Making

An All-Bond Portfolio at Retirement? Just Say No

Asset Allocation by Age: 20s and 30s, 40s and 50s, 60s

Age and risk tolerance key to mastering asset allocation

The Proper Asset Allocation Of Stocks And Bonds By Age

What Is Portfolio Diversification? - Fidelity

Shifting Toward Bonds as Retirement Nears? 3 Mistakes to Avoid

We're retired and recently lost $100K from our portfolio. Our adviser said 'we could lose another $100K in 2023.' Is that crazy? - MarketWatch

Your portfolio should be 100% stocks, even in retirement

de

por adulto (o preço varia de acordo com o tamanho do grupo)