Historical Social Security and FICA Tax Rates for a Family of Four

Por um escritor misterioso

Descrição

Average and marginal employee Social Security and Medicare (FICA) tax rates for two-parent families of four at the same relative positions in the income distribution from 1955 to 2015.

What are the Social Security trust funds, and how are they financed?

United States Social Security Rate

The ROI On Paying Social Security FICA Taxes

The Distribution of Household Income, 2019

Increasing Payroll Taxes Would Strengthen Social Security

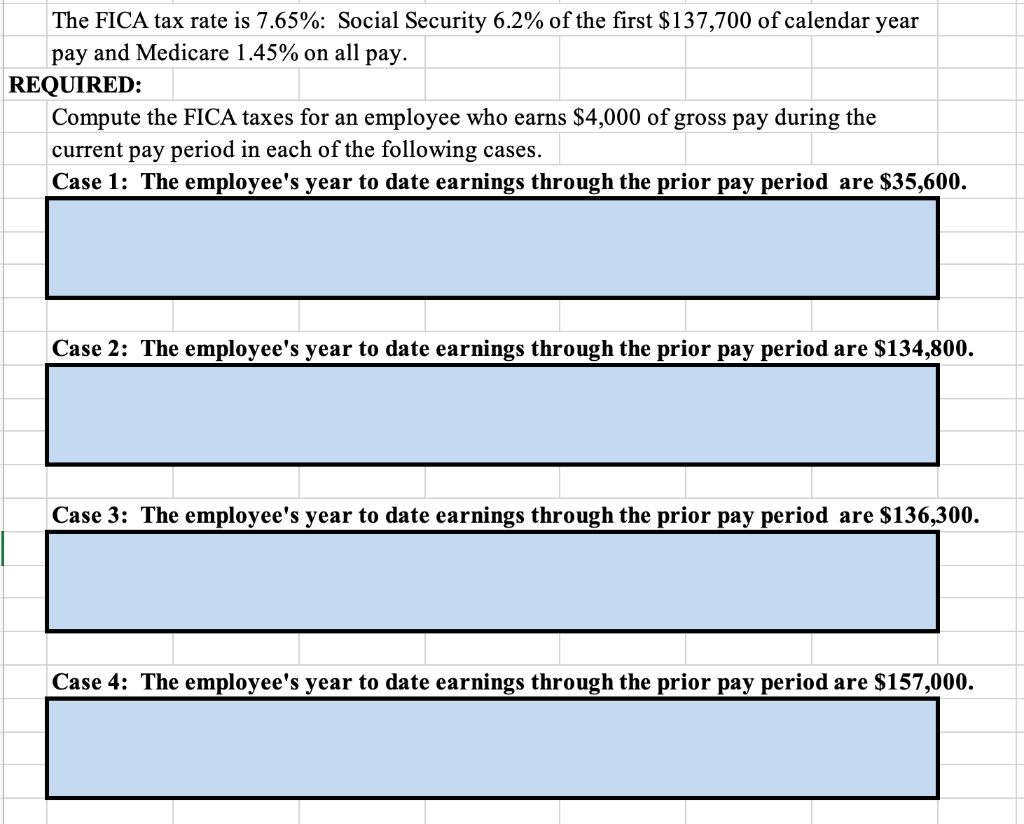

Solved The FICA tax rate is 7.65%: Social Security 6.2% of

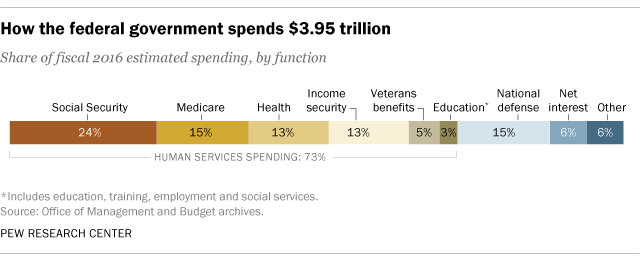

Putting federal spending in context

Is Social Security Worth Its Cost?

Historical Federal Income Tax Rates for a Family of Four

Who Pays Federal Income Taxes? IRS Federal Income Tax Data, 2023

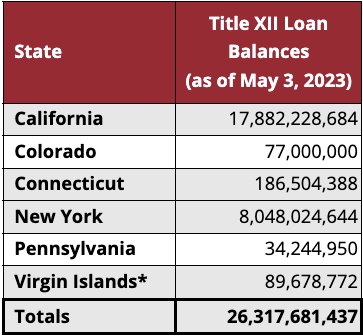

Outlook for SUI Tax Rates in 2023 and Beyond

de

por adulto (o preço varia de acordo com o tamanho do grupo)