Independent Contractor: Definition, How Taxes Work, and Example

Por um escritor misterioso

Descrição

An independent contractor is a person or entity engaged in a work performance agreement with another entity as a non-employee.

What Is a 1099 Form, and How Do I Fill It Out?

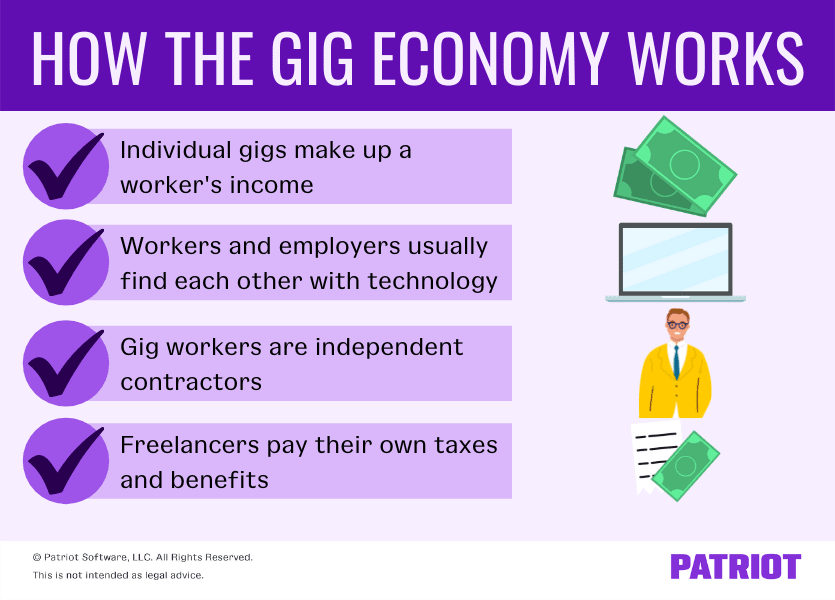

Gig Economy Who Are Gig Workers and What Is the Gig Economy?

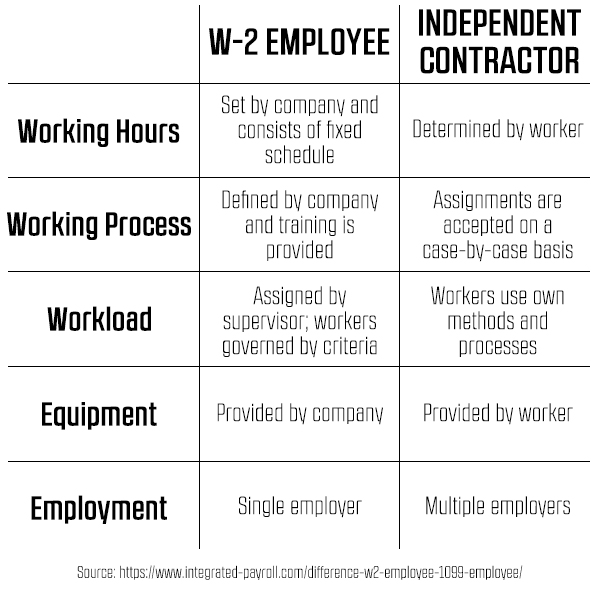

Do You Need a W-2 Employee or a 1099 Contractor? - How to Start

How To File And Pay Independent Contractor Taxes – Forbes Advisor

1099 vs W-2: What's the difference?

:max_bytes(150000):strip_icc()/FormW-94-d634d707ffee44839b5a46c998bd71aa.png)

What Is IRS Form W-9?

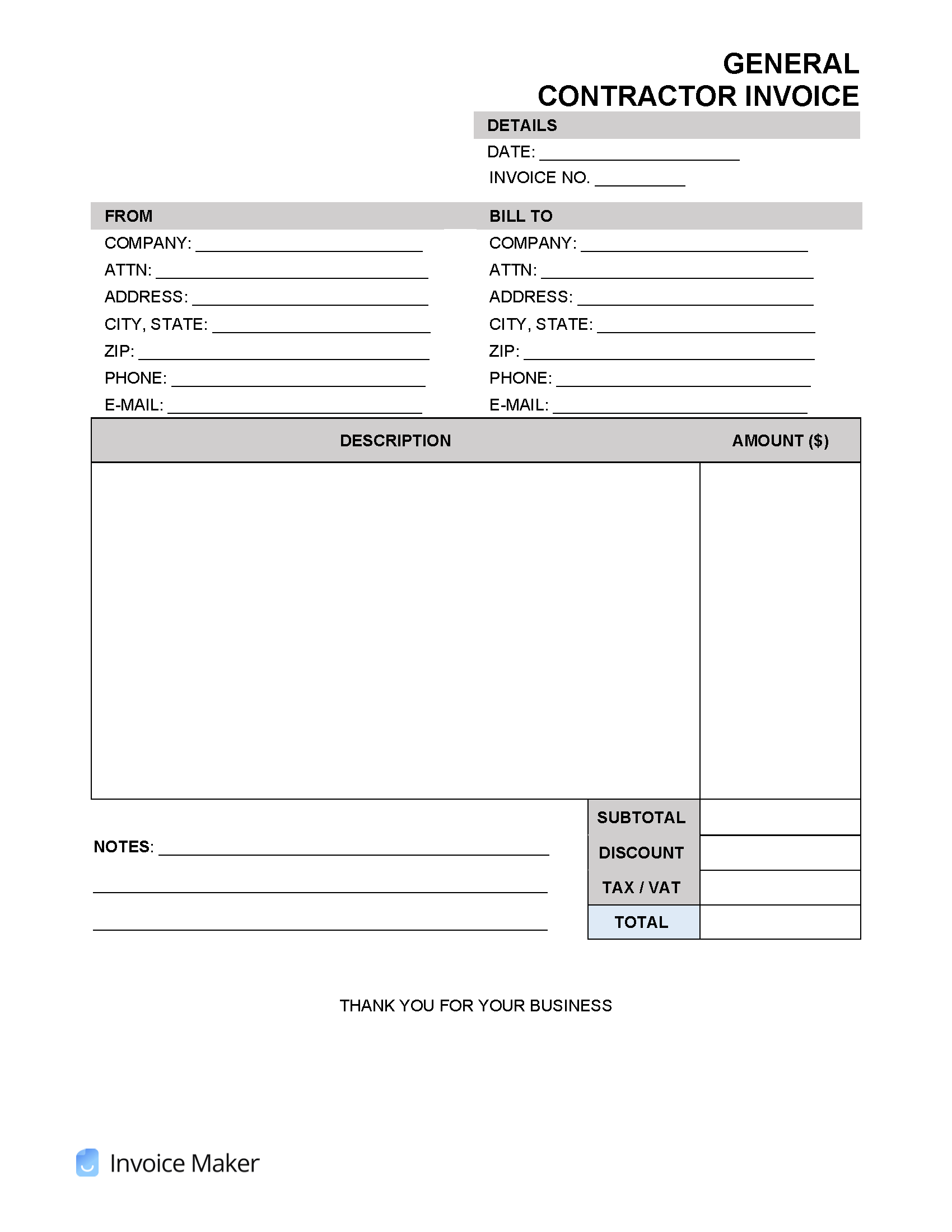

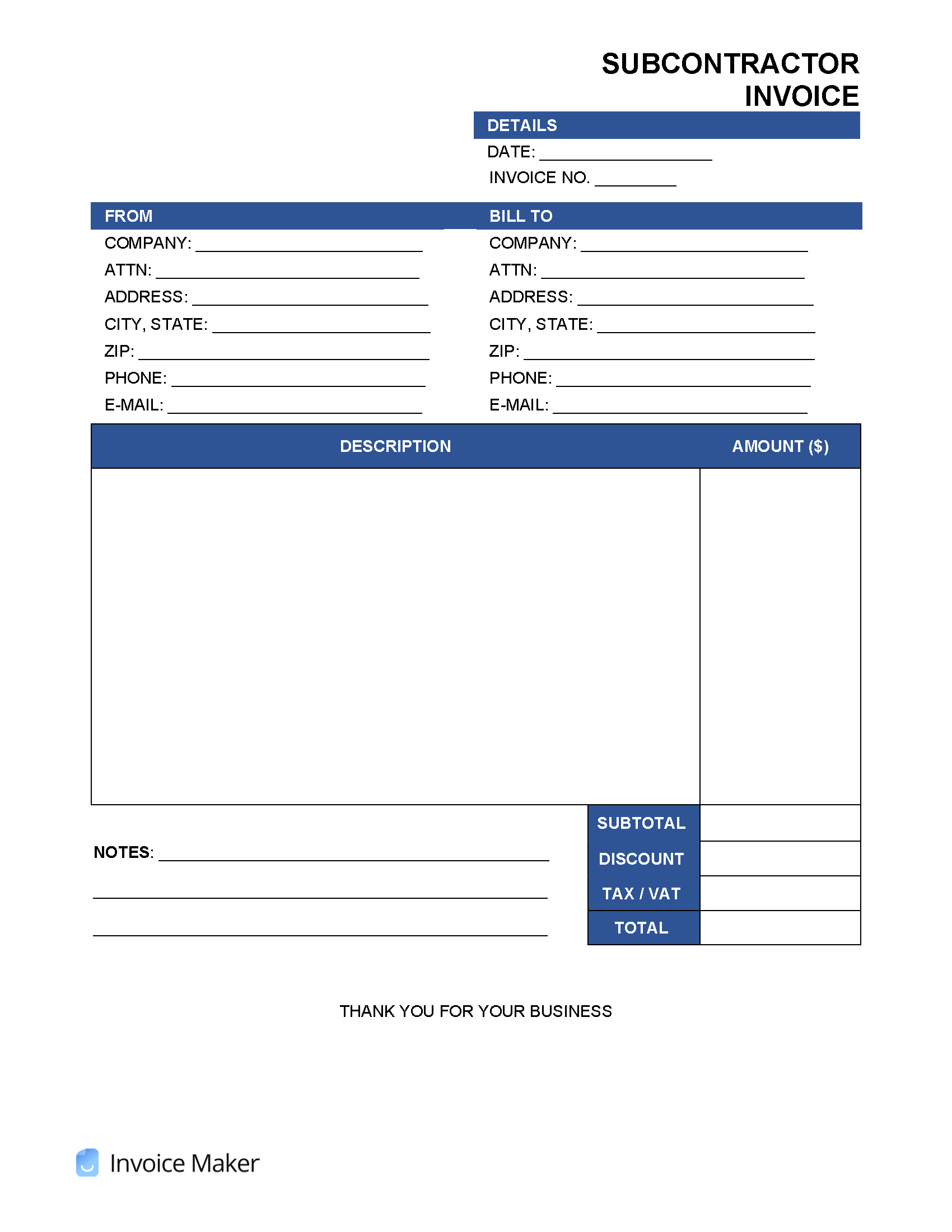

Independent Contractor (1099) Invoice Template

Independent Contractor (1099) Invoice Template

Employee vs Independent Contractor - Inland Revenue Division

The Independent Contractor Tax Rate: Breaking It Down • Benzinga

Easy Guide to Independent Contractor Taxes: California Edition

How Much Should I Save for 1099 Taxes? [Free Self-Employment

de

por adulto (o preço varia de acordo com o tamanho do grupo)

:max_bytes(150000):strip_icc()/FinancialLiteracy_Final_4196456-74c34377122d43748ed63ef46a285116.jpg)