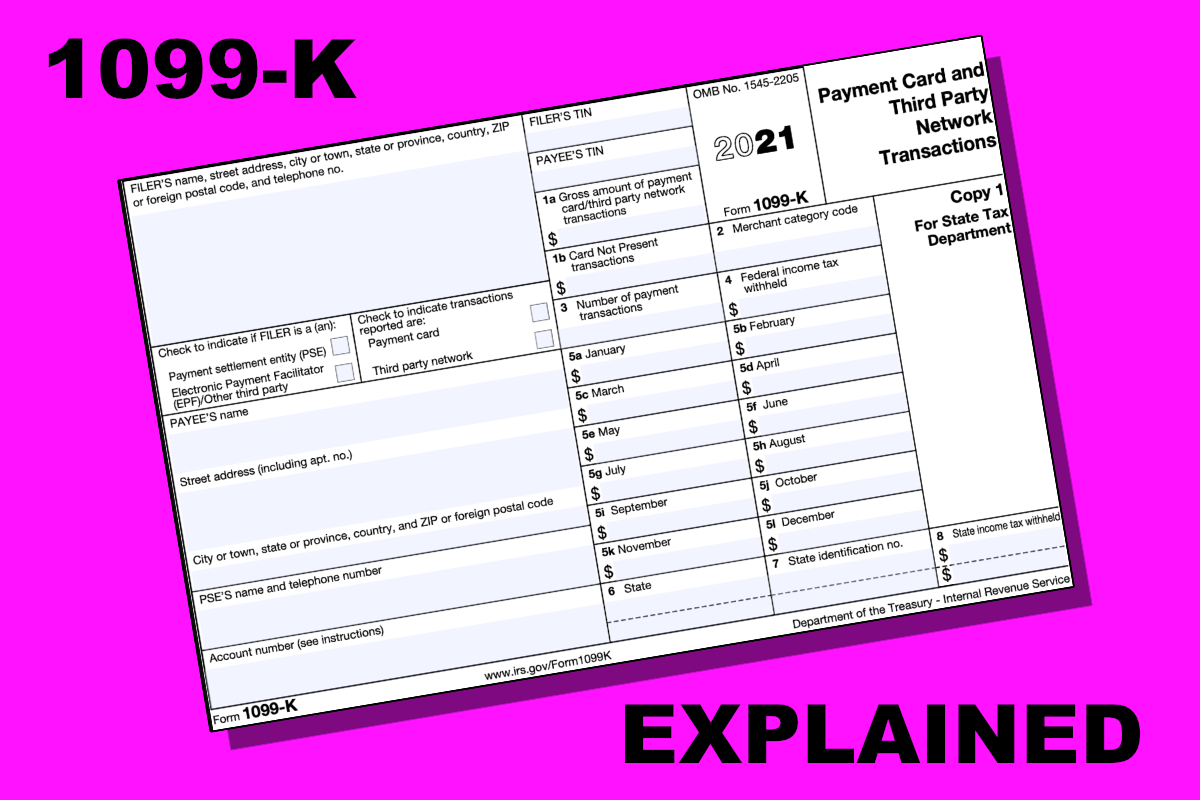

or Sale of $600 Now Prompt an IRS Form 1099-K

Por um escritor misterioso

Descrição

Starting in 2022, selling as little as $600 worth of stuff on a site like , or Facebook Marketplace, will prompt an IRS 1099-K.

New tax laws 2022: Getting paid on Venmo or Cash App? This new tax rule might apply to you - ABC7 New York

Here's why you may get Form 1099-K for third-party payments in 2022

Sandy Dobson CPA PC

IRS will delay $600 1099-K reporting for a year - Don't Mess With Taxes

1099-K Forms - What , , and Online Sellers Need to Know

Tax Forms on Teachable – Teachable

What the new IRS tax rules are for Venmo, PayPal, Cash App

Form 1099-K: Last-Minute IRS Changes & Tax Filing Requirements [Updated for 2024]

What is a 1099-K Form?

Explaining the 1099-K tax rule for reporting online sales over $600

IRS Suspends $600 Form 1099-K Reporting - What You Need to Know

de

por adulto (o preço varia de acordo com o tamanho do grupo)